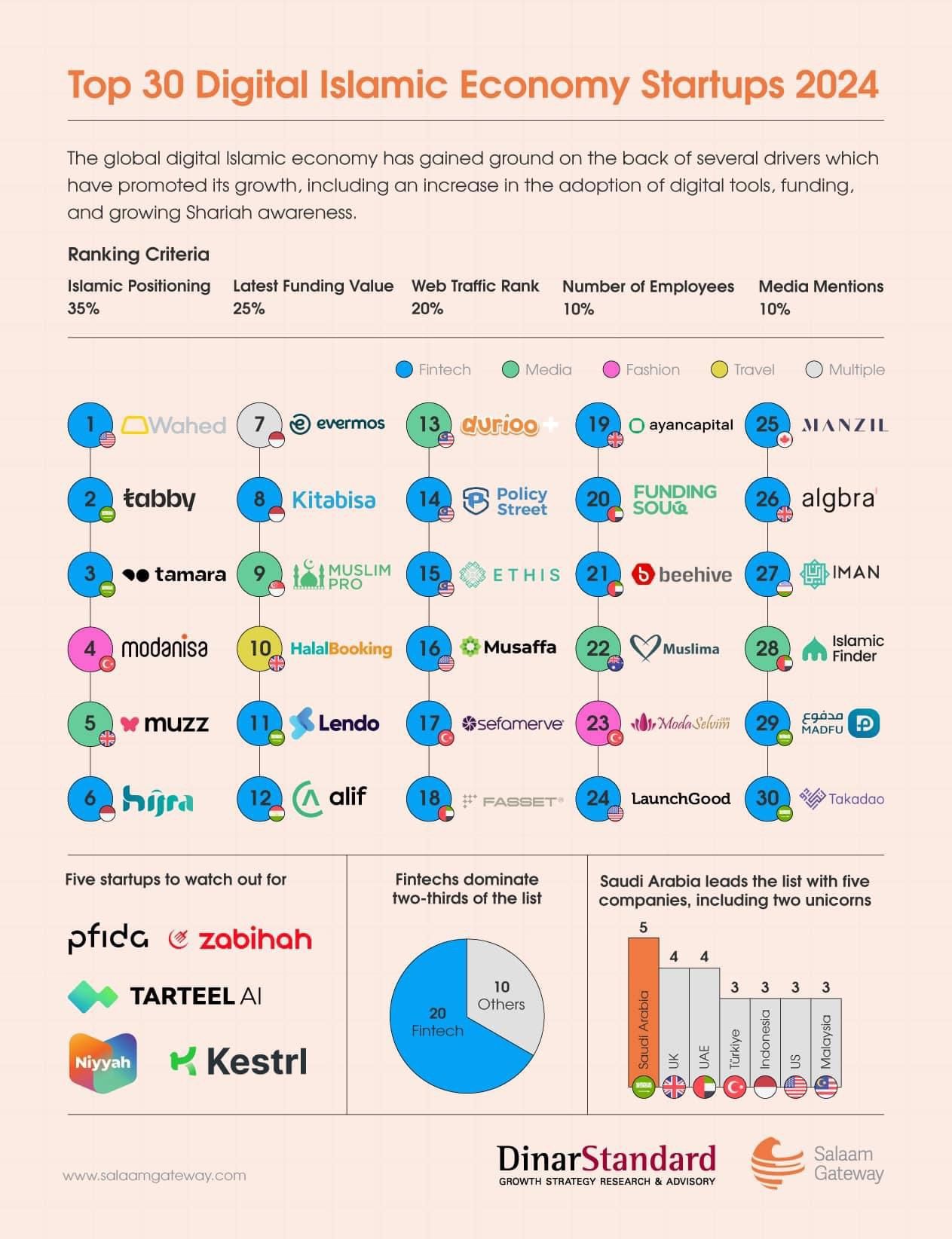

With the advancement of the global digital wave, the Islamic economy, especially in the field of fintech, is experiencing unprecedented innovation and development. According to the 2024 Global Digital Islamic Economy Startup Ranking recently released by the Islamic finance professional consulting agency Salaam Gateway (see chart below), we can see a series of remarkable innovative companies that are shaping and expanding the Islamic economy and financial sector.

From the analysis and ranking of this chart report, we see that Islamic fintech companies are developing and rising. Fintech companies occupy a significant position on this list, reflecting the rapid development of Islamic fintech and its potential to meet the specific needs of the Muslim community. These startups are changing the way the traditional financial industry operates by providing financial products and services that comply with Islamic law (Shariah). In addition to fintech, other industries such as media, Islamic insurance, fashion, tourism, and real estate also have a place in the digital Islamic economy. These companies, through innovative methods, meet the needs of the Muslim community in different fields, from halal food certification to travel services in line with Islamic teachings. For example, companies like Wahed and tabby are at the forefront of the list, providing innovative financial solutions to help the Muslim community better manage assets and investments. Companies like modanisa and HalalBooking focus on fashion and tourism, providing services that align with the values and lifestyle of Muslim consumers.

Undoubtedly, in the wave of the global digital Islamic economy, fintech startups are reshaping the face of financial services with their unique innovative practices. These companies not only follow the core principles of Islamic law but also provide more diversified and convenient financial solutions for the Muslim community through the power of technology. Their main business and innovative practices mainly include the following aspects:

Interest-free financial models: Islamic fintech companies replace traditional interest loans and investments with profit-sharing, leasing, or commodity trading models, which not only comply with Islamic law principles but also provide new ways of cooperation for investors and borrowers.

Asset tokenization: Using blockchain technology, these companies transform physical assets into digital tokens, making investments more transparent and accessible while ensuring the sharing of profits and risks.

Halal investment screening: Fintech startups have developed advanced screening tools to help investors identify and select investment opportunities that comply with Islamic law principles, excluding companies involved in industries that are taboo in Islam.

Islamic insurance (Takaful) services: Developing Islamic insurance business through digital technology, Islamic insurance companies provide insurance based on the principle of mutual assistance, which is in stark contrast to traditional insurance products based on interest.

Risk management and compliance: Using data analysis and artificial intelligence technology, these companies can manage risks more effectively while ensuring the compliance of their products and services with Islamic law.

Education and awareness: Online platforms and applications provide rich educational resources to help users better understand Islamic finance principles and make wise financial decisions.

Community participation and transparency: Islamic fintech startups emphasize community participation and transparency, ensuring that all financial activities can be understood and supervised by community members.

Environmental, social, and governance (ESG) factors: Many companies also include ESG factors in their investment decision-making process, which is consistent with the moral and social responsibilities emphasized by Islam.

Conclusion

With the popularization of digital tools, the injection of funds, and the enhancement of Shariah awareness, startups in the Islamic economy are facing unprecedented growth opportunities. These companies not only promote economic development but also provide richer and more diverse choices for the global Muslim community. Through research and consulting from professional institutions such as Salaam Gateway, we look forward to seeing more innovative companies emerging in the Islamic economy.