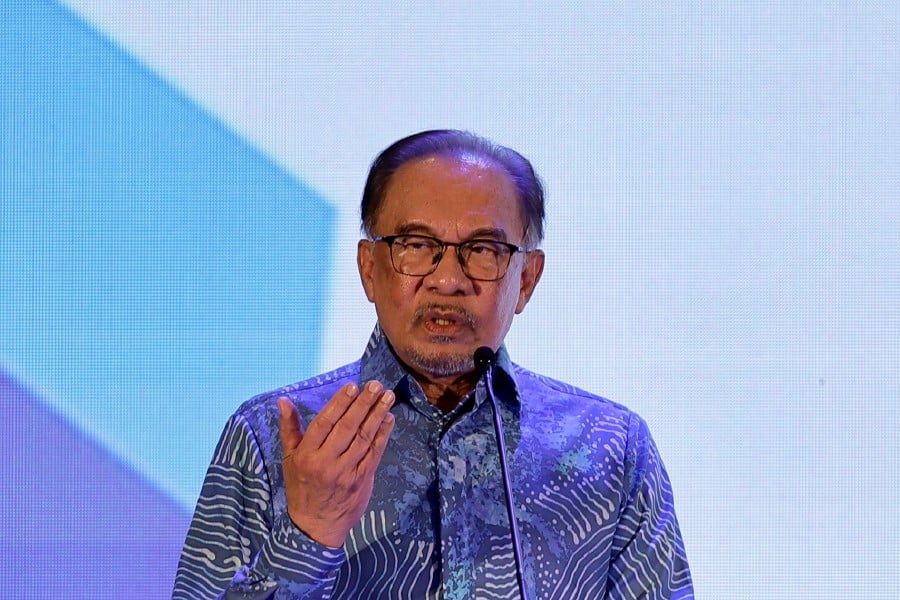

Prime Minister Datuk Seri Anwar Ibrahim said that Malaysia will spearhead the development of a global programme for Islamic economists, aimed at cultivating a group of dynamic and highly-skilled economists with knowledge and expertise in Islamic economics to ideate solutions that address contemporary global challenges. — BERNAMA

KUALA LUMPUR: Malaysia will spearhead the development of a global programme for Islamic economists.

Prime Minister Datuk Seri Anwar Ibrahim said the programme is aimed at cultivating a group of dynamic and highly-skilled economists with knowledge and expertise in Islamic economics to ideate solutions that address contemporary global challenges.

"It is a multi-track programme offering executive education, applied research and working internship for participants to gain professional experience.

"I am also glad that the Islamic finance industry in Malaysia, through the MIFC Leadership Council (MLC), is taking the lead in embracing innovation and impact-driven initiatives," he said in his keynote address at the Global Forum on Islamic Economics and Finance (GFIEF).

He said the MLC position paper outlined priorities to drive islah (reform) of Islamic finance, expanding from 'halal to tayyib' (good quality), to further advance Malaysia's national aspirations and contribute to the betterment of the ummah.

Earlier, Anwar, who is also finance minister, said Malaysia remained committed to the net-zero carbon emissions target by 2050 and building a resilient and sustainable economy.

"The initiatives under the National Energy Transition Roadmap are a testament to our resolve in addressing the climate challenges of our times."

Anwar also called on leaders of the Organisation of Islamic Cooperation (OIC) to intensify efforts and enhance cross-border access to bolster innovation, trade, and investments.

He highlighted that despite the significant global presence of Islamic trade finance, it currently constituted less than five per cent of the overall trade finance activities conducted by member countries.

To support global OIC trade, he said Malaysia intended to implement government-to-government (G2G) facilitation leveraging Islamic trade finance.

This initiative aims to foster economic cooperation among OIC countries, underscoring Malaysia's commitment to advancing trade and collaboration within the OIC community.

The two-day forum, organised by Bank Negara Malaysia in collaboration with the SC, Labuan Financial Services Authority, the International Islamic Liquidity Management Corporation, the Islamic Development Bank, the Islamic Financial Services Board, and the World Bank Group, underscores Malaysia's commitment to advancing Islamic finance on the global stage.

Themed "Shaping a Resilient Global Islamic Economy Through Values-based Reforms", GFIEF sees policymakers, business leaders, and financial service providers from all around the world gathered to engage in discussion and collaborate to build a future where Islamic economics and finance can play a pivotal role in fostering shared prosperity and equity.